Refrain from exchanging ATM cards

05 Sep 2023

Customers are advised to refraing from exchanging their ATM cards for transactions.

In an interview on Monday, First National Bank Botswana (FNBB) director of marketing and communications, Ms Peo Porogo said by exchanging ATM cards customers were exposing their account details to a third party , which she might result in a security breach.

She said the process of using ATM cards for cash deposits was introduced as a control measure to ensure that all depositors could be identified since their accounts would have been subjected to Know Your Customer (KYC) processes.

She said unfortunately, the practice compromised this control as the depositor details captured would be that of the card owner and not the true depositor.

Ms Porogo discouraged exchanging cards to make deposits saying it compromised security and that it contribute ATM Card Fraud. She reiterated that privacy breaches occurred when personal information get stolen or lost or collected and used or disclosed without authority.

“This occurs when personal information is stolen or lost or is collected, used or disclosed without authority.” In the event of a customer borrowing a third party a bank card, Ms Porogo said all its details including, card number, CVV numbers, and expiry date may be exposed and used to transact online without prior consent of the rightful owner.

When describing ATM card fraud, she said usually an unknown person would approach the victim and borrow their card.

Upon completing the deposit transaction, Ms Porogo said the person would find an opportunity to view the details of the card such as the PIN which the fraudster would use to defraud unsuspecting card owner.

She said that by time the victim realised what had happened and arranged to cancel the card their money would have already been withdrawn.

Ms Porogo said they were aware that privacy breaches and ATM card fraud could lead to money laundering and financing of terrorism. Therefore, she said it was important for customer education on how to avoid or detect these scams to avoid falling victims of illicit financial flows.

Moreover, Ms Porogo said customers should understand that by assisting others in this manner would only have transactions being traced back to them as card owners. Notably, she said in some situations the card owner might be held liable for any criminal activity associated with the transaction.

Ms Porogo underlined that the bank would continue to educate customers on the risks of such practices and advise them to always be vigilant of scammers. ENDS

Source : BOPA

Author : Marvin Motlhabane

Location : GABORONE -

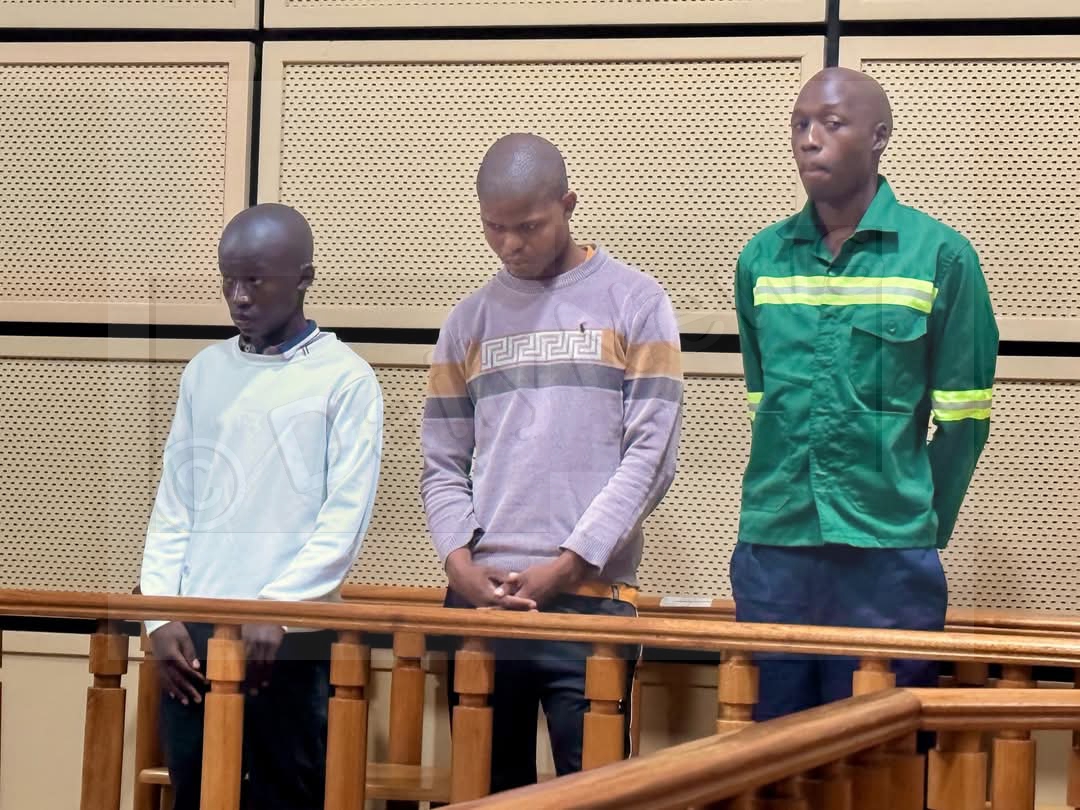

Event : COURT

Date : 05 Sep 2023