Whats my cut in a diamond

25 Nov 2013

The formula of how a Motswana benefits from the sale of diamonds may sound a bit elitist but once the equation is unpacked even lay minds start to comprehend the issue.

In fact, in this particular business model, the taxpayer benefits more than once in the revenue accrued from diamond sales. It actually sounds more like selling one commodity several times to different entities, a classic case of commercial prudence.

“Obviously government enjoys the tax revenue charged on Debswana as a mining company operating within the country as well as royalties of diamond sales,” says Mmetla Masire, Coordinator of Relocation and Opportunities office housed in the Diamond Hub.

Debswana is a company half owned by government while the other share is owned by De Beers and the tax it pays goes into the national consolidated fund. De Beers also as a single entity trading in Botswana, pays company tax for its other operations such as prospecting for minerals.

“Once Debswana has made its profit it then has to pay dividends to the government being the shareholder and that is usually a lot of money,” Mr Masire adds. So far mining, especially diamonds are the highest revenue earner for government across the economy of Botswana.

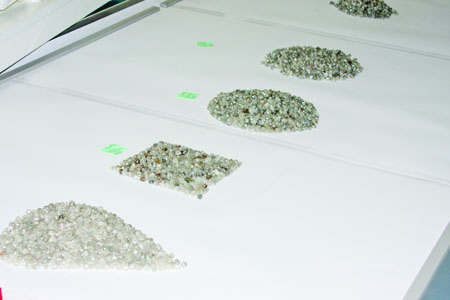

Once diamonds have been mined, which area is a specialty of Debswana, they are then taken to the world’s largest and most sophisticated rough diamond sorting and valuing operation, the Diamond Trading Company Botswana (DTCB). The facility, just like Debswana, is also an equal share joint venture between government and De Beers and pays tax to government every year.

The DTCB also has a sales and marketing function responsible for local sales of aggregated diamonds. Aggregation, says Mr Masire, is a process of blending together and preparation for sale of diamonds from various producer countries. Presently, he adds, DTCB sells diamonds to 21 cutting and polishing companies that have been licenced by government. As is the case with Debswana, the DTCB also has to pay dividends to shareholders [government and De Beers] after declaring its profit.

“And furthermore all these 21 sightholders pay their tax in Botswana and as is practice the money goes into the national coffers.”

The overarching intention, says Mr Masire, is to maximise profit from one stone mined.

“We have taken advantage of every opportunity so far to avail, to Batswana, information on how they can benefit in various ways from the relocation of the De Beers Global Sightholder Sales from London to Gaborone,” he says. The DBGSS has already started selling diamonds to around 80 global site-holders plus a further 21 that are locally based.

Opportunities emanating from the DBGSS relocation, says Mr Masire, have been categorised into four main streams. At the top are potential direct beneficiaries who include entities that directly work with diamonds such as polishing and jewellery firms.

“Since diamonds are now mined and sold here, it should make sense for business people to even process them into final products closer to the point of production,” says Mr Masire.

And because the risk profile of diamonds is different from all other commodities, he says specialised security transporters and banks are expected to set up in Botswana and as a result create employment while paying their taxes here. Huge opportunities also exist for general outsourced services such as catering companies, human resource services and parameter security companies which have been classified as the third stream. Other downstream activities expected to benefit from DBGSS setting up here include hospitality, shuttle services and all other operations that do not have a direct bearing on the production of diamonds.

“The intention is to eventually have a sustainable activity in the diamond pipeline to the extent that everything can be sourced locally,” Mr Masire emphasises. Once all that has been achieved, says Mr Masire, it is then that Botswana can be called a fully-fledged diamond center. “The relocation of DBGSS itself brings diamond dealers traffic to Botswana and once they are here they should be able to make informed business decisions based on what they see here,” says Mr Masire on the nation’s aim to set up a globally competitive diamond centre. ENDS

Source : BOPA

Author : Rebaone Tswiio

Location : GABORONE

Event : Business feature

Date : 25 Nov 2013