Hope to economic revival remain

22 Dec 2021

The year 2021 saw a somewhat ‘W’ shaped recovery in the nation’s economy, which was propelled by events emanating from the COVID-19 pandemic across the globe.

Notably, chances of diversifying the economy proved somehow bleak due to EU’s grey listing.

However, the plenary held in October 21 in Paris, France saw the Financial Action Task Force (FATF) remove Botswana from its grey list of jurisdictions, which spurred optimism in boosting efforts to diversify the economy and attract Foreign Direct Investment (FDI).

In line with this development, the negative impact of COVID-19 on the economy has been easing in recent months, with an improvement in economic growth.

The global diamond industry had recovered since the last quarter of 2020, and this momentum has been maintained in 2021, resulting in the domestic economy expected to grow by 9.7 per cent in 2021.

According to Bank of Botswana, real Gross Domestic Product (GDP) grew by 4.9 per cent in the year to June 2021, compared to a contraction of 5.1 per cent in the corresponding period in 2020.

The growth is attributable to the expansion in production of both mining and non-mining sectors.

At regional level, GDP for Sub-Saharan Africa is estimated to have contracted by 1.7 per cent in 2020, but is expected to rebound to a growth rate of 3.7 per cent and 3.8 per cent in 2021 and 2022, respectively.

However, growth prospects are subject to downside risks, mainly due to the tightening of global financial conditions, the general decline in global trade, the spread of COVID-19 infections and the emergence of new variants combined with slow vaccine roll out.

On the domestic front, the economy contracted by 8.5 per cent in 2020 in real terms, compared to three per cent growth in 2019.

This outturn was expected, given the sharp GDP contractions of 26 per cent and 4.4 per cent in the second and third quarters of 2020.

The negative growth rate of 8.5 per cent in 2020 reflected contraction in most sectors of the economy due to the unprecedented impact of COVID-19.

Financial and business service sector continues to be the future driver of economic diversification.

With the global economic activity opening up following successful vaccination programmes, especially in the developed countries, the local economy was predicted to register growth of above nine per cent by both the Ministry of Finance and Economic Planning and the International Monetary Fund (IMF).

Therefore, in pursuit to aid businesses to recovery from the scourging predicaments of COVID-19 that affected their balance sheets, government intervened with the Industry Support Facility, which is a component of Economic Recovery and Transformation Plan (ERTP).

The facility benefitted 252 applicants through financial assistance in the form of interest-free loans and it had disbursed P100 million by September.

The agricultural sub-sectors that benefitted include; livestock, poultry, horticulture, dairy, small stock and piggery, with the distribution of the funds across the sub-sectors having supported 4 212 agricultural jobs during the COVID-19 pandemic.

During his budget presentation in February, the then finance minister, Dr Thapelo Matsheka painted a picture of an economy that was out of the woods, but needed a bit of a catalyst in the form of increased Value Added Tax (VAT) and introduction of some levies.

This was because the country was to experience yet another year of budget deficit, as has been the case since the beginning of the National Development Plan (NDP) 11.

Previously, government had planned to have a balanced budget before registering a supplement, but due to the effects of the pandemic, this has remained elusive.

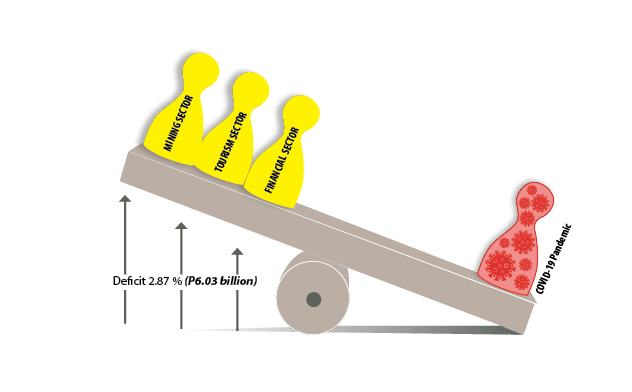

For the 2021/22 national budget, the minister forecasted a deficit of P6.03 billion or 2.87 per cent of GDP, and given the tough economic situation the country experienced, the government introduced measures of raising revenues.

These included the increasing of VAT by two per cent from 12 to 14 per cent, introducing a levy on second car imports and on sugary beverages as well as increasing withholding tax on dividends from 7.5 per cent to 10 per cent.

The introduction of these tax amendments, together with an upward adjustment of administered prices (such as fuel), resulted in inflation outgrowing the 3-6 per cent of the objective range set by Bank of Botswana.

Inflation reached 8.8 per cent in October, but the central bank remained confident it would slow down in the short term, hence maintaining the bank rate at 3.75 per cent.

The tax amendment offered relief however, as the threshold was increased from P36 000 to P48 00 per annum and further, Batswana were offered tax amnesty as they only had to pay principal tax owed minus interests and penalties.

As for the foreign reserves, at the end of September this year, the foreign exchange reserves amounted to P52.1 billion, a decrease of 11.4 per cent from P58.8 billion in September last year.

In May last year, the government adjusted the downward rate of crawl of the Pula exchange from 1.51 per cent to 2.87 per cent.

The pula basket weights were maintained at 45 per cent for the rand and 55 per cent for the IMF’s Special Drawing Right (SDR), for the remainder of 2020.

These were maintained this year.

In an effort to revitalise and diversify the tourism sector, government redeveloped the Kasane/Kazungula area and the country promoted tourism amidst the pandemic, through virtual platforms and engagements.

These included Virtual Botswana Travel and Tourism Expo in December 2020; the virtual International Tourism Borse in March 2021 and Botswana Live Virtual Tours campaign, launched in August 2021.

These platforms had been instrumental in stimulating the recovery of the tourism sector at both local and international levels.

In addition, a total of 5 432 companies received funding amounting to P139 786 942 under the COVID-19 wage subsidy, which covered salaries and company operations.

The government’s efforts in reviving the economy proofed worthwhile, since the country has, according to RMB 2021, been placed in position five because of its high foreign-exchange reserves, which had enabled it to weather the COVID-19 pandemic-induced economic storm better than most countries in Africa.

The pula fund, a sovereign fund that finances a large part of the budget deficit, created in 1994, has meant that fiscal dependency on debt has been lower than that of other African countries. ENDS

Source : BOPA

Author : Marvin Motlhabane

Location : GABORONE

Event : Feature

Date : 22 Dec 2021